Understanding the Apple Pay Maximum Amount

Apple Pay, a convenient and secure mobile payment service, has established limits on transaction amounts to ensure financial security and prevent excessive spending. Knowing these limits is crucial for users to manage their finances effectively.

The maximum transaction amount for Apple Pay varies depending on several factors, including the merchant's policies, the user's bank or credit union, and the specific payment method used. Generally, contactless payments made through Apple Pay have a lower limit than in-app purchases or online transactions.

These limits are implemented to protect users from unauthorized purchases and potential fraud. By setting maximum amounts, Apple Pay helps prevent individuals from overspending or falling victim to scams.

Understanding the Apple Pay maximum amount is essential for users to plan their purchases, avoid declined transactions, and maintain control over their finances. It's always advisable to check with the merchant or your financial institution for specific limits applicable to your account and transaction type.

The Apple Pay Maximum Amount

The Apple Pay maximum amount is a crucial aspect of the service, ensuring financial security and preventing overspending. Here are ten key aspects to explore:

- Transaction Limits: Vary based on merchant policies, bank regulations, and payment method.

- Contactless Payments: Typically have lower limits than in-app or online purchases.

- Fraud Prevention: Limits help protect users from unauthorized transactions and scams.

- Financial Control: Enables users to manage their spending and avoid excessive purchases.

- Merchant Policies: Businesses may set their own maximum amounts for Apple Pay transactions.

- Bank Regulations: Financial institutions establish limits based on account type and risk factors.

- Payment Method: Credit cards often have higher limits than debit cards.

- In-App Purchases: May have different limits compared to contactless or online payments.

- Online Transactions: Typically have higher limits due to increased security measures.

- Temporary Increases: Merchants or banks may temporarily increase limits for specific promotions or purchases.

These aspects highlight the importance of understanding the Apple Pay maximum amount. By being aware of these limits, users can plan their purchases effectively, avoid declined transactions, and maintain control over their finances. It's always advisable to check with the merchant or your financial institution for specific limits applicable to your account and transaction type.

Transaction Limits

Transaction limits are a crucial aspect of the Apple Pay maximum amount, as they determine the maximum amount that can be transacted using Apple Pay. These limits vary based on several factors:

- Merchant Policies: Merchants may set their own maximum transaction amounts for Apple Pay payments. This is common for high-value items or services.

- Bank Regulations: Banks and credit unions establish transaction limits based on account type, creditworthiness, and fraud prevention measures.

- Payment Method: Different payment methods, such as credit cards, debit cards, and prepaid cards, may have varying transaction limits imposed by the issuing bank or financial institution.

Understanding these factors and their impact on transaction limits is essential for users to plan their purchases effectively. By being aware of the maximum amount that can be transacted using Apple Pay, users can avoid declined transactions and ensure a smooth checkout process.

Contactless Payments

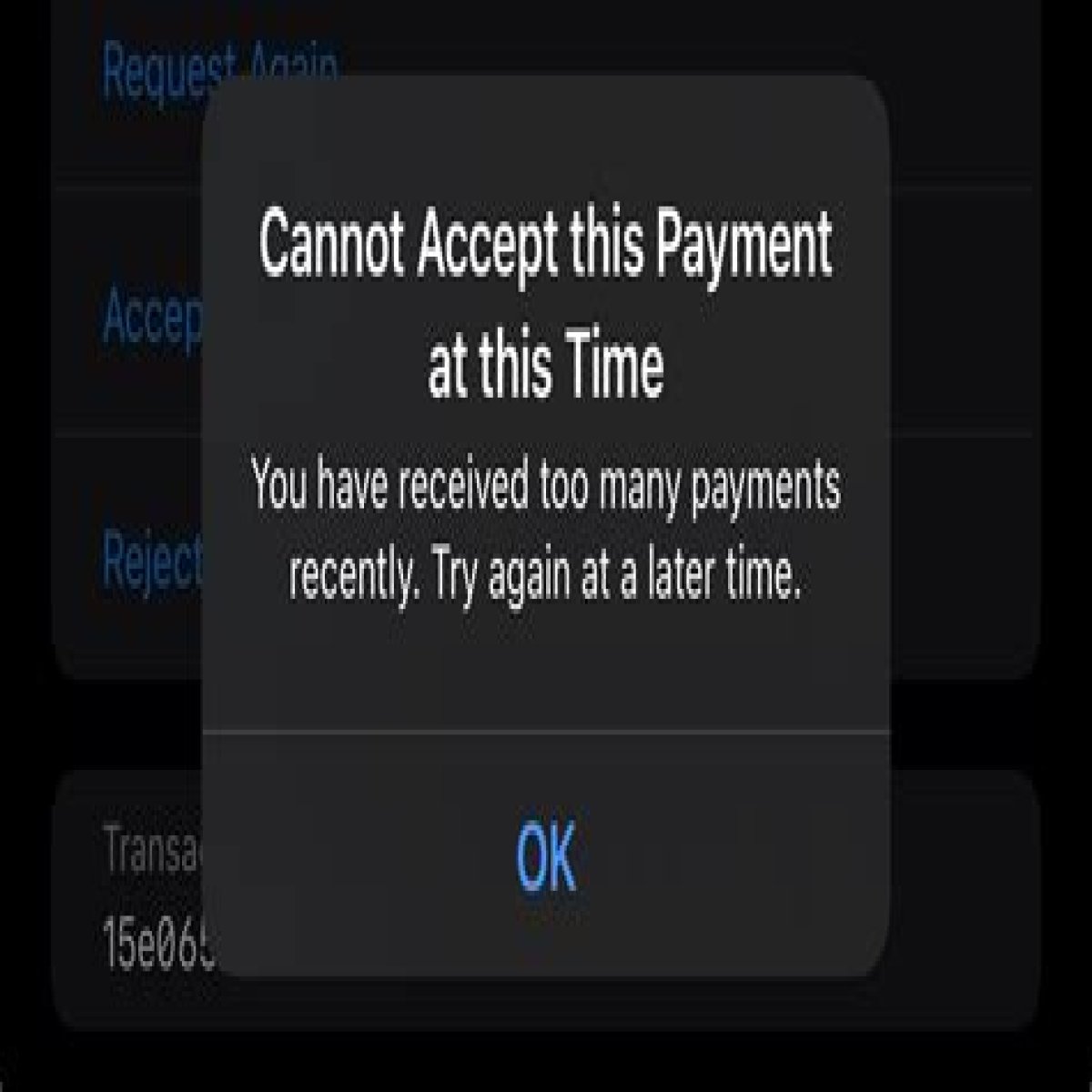

The lower limits imposed on contactless payments compared to in-app or online purchases are a crucial aspect of "The Apple Pay Maximum Amount: Discoveries And Insights." This distinction is primarily driven by security considerations.

Contactless payments, which involve tapping the Apple Pay device on a payment terminal, are generally considered less secure than in-app or online purchases. This is because contactless payments do not require the user to enter a PIN or provide a signature, making them more susceptible to fraud and unauthorized transactions.

To mitigate these risks, many merchants and financial institutions set lower transaction limits for contactless payments. This helps to minimize potential losses in case of unauthorized transactions or fraud. In contrast, in-app and online purchases often require additional security measures, such as PIN entry or 3D Secure authentication, which reduces the risk of fraud and allows for higher transaction limits.

Understanding the lower limits associated with contactless payments is essential for users to plan their purchases and avoid declined transactions. It is advisable to use in-app or online payment methods for high-value purchases or when enhanced security is desired.

Fraud Prevention

In the context of "The Apple Pay Maximum Amount: Discoveries And Insights", fraud prevention is a crucial aspect that underpins the establishment of transaction limits. These limits serve as a protective measure to safeguard users from unauthorized transactions and scams.

- Transaction Monitoring: Limits help financial institutions and Apple Pay to monitor transaction patterns and identify suspicious activities. By setting maximum amounts, they can flag transactions that exceed normal spending habits or deviate from established patterns, potentially indicating fraud.

- Unauthorized Transaction Prevention: Limits prevent fraudsters from making large unauthorized purchases or withdrawing excessive funds from users' accounts. By restricting the amount that can be transacted, Apple Pay reduces the potential losses incurred in the event of a compromised device or stolen credentials.

- Scams Mitigation: Limits help mitigate scams that attempt to trick users into authorizing fraudulent transactions. By setting a maximum amount, users are less likely to fall victim to scams that involve high-pressure tactics or emotional manipulation.

- Enhanced Security: Transaction limits complement other security measures implemented by Apple Pay, such as tokenization and encryption. By combining these layers of protection, Apple Pay creates a robust security framework that minimizes the risk of fraud and unauthorized transactions.

Overall, the fraud prevention aspect of transaction limits is integral to "The Apple Pay Maximum Amount: Discoveries And Insights". These limits empower users with greater control over their finances and provide peace of mind by safeguarding their accounts from fraudulent activities.

Financial Control

In the context of "The Apple Pay Maximum Amount: Discoveries And Insights", financial control plays a crucial role in empowering users to manage their spending and avoid excessive purchases.

Transaction limits, a key component of the Apple Pay maximum amount, serve as a tool for financial control. By establishing limits on transaction amounts, users can set boundaries for their spending and prevent impulsive or unnecessary purchases. This is particularly beneficial for individuals seeking to control their expenses, manage debt, or save for financial goals.

Furthermore, transaction limits promote financial responsibility by encouraging users to plan their purchases and make informed decisions about how they spend their money. By preventing users from overspending or making large, unaffordable purchases, Apple Pay helps foster healthy financial habits and long-term financial well-being.

In essence, financial control is a cornerstone of "The Apple Pay Maximum Amount: Discoveries And Insights." By providing users with the ability to manage their spending and avoid excessive purchases, Apple Pay empowers individuals to take control of their finances and achieve their financial objectives.

Merchant Policies

The ability of businesses to set their own maximum amounts for Apple Pay transactions is a significant aspect of "The Apple Pay Maximum Amount: Discoveries And Insights." This policy allows merchants to tailor transaction limits based on their specific business needs and risk tolerance.

- Tailored Limits: Businesses can adjust transaction limits to suit the average purchase value of their products or services. This flexibility enables merchants to optimize the checkout process and minimize the risk of declined transactions.

- Fraud Prevention: By setting lower limits for high-risk transactions or purchases, merchants can reduce the potential financial impact of fraud and unauthorized transactions.

- Compliance: Merchants may need to adhere to industry regulations or internal policies that dictate transaction limits for certain types of goods or services.

- Customer Experience: Businesses can strike a balance between security and convenience by setting limits that allow for smooth transactions while mitigating risks.

In summary, merchant policies regarding maximum transaction amounts play a crucial role in "The Apple Pay Maximum Amount: Discoveries And Insights." These policies empower businesses to manage risk, enhance customer experience, and comply with regulations while contributing to the overall security and efficiency of the Apple Pay ecosystem.

Bank Regulations

Bank regulations are a fundamental component of "The Apple Pay Maximum Amount: Discoveries And Insights" as they empower financial institutions to establish transaction limits based on account type and risk factors. This plays a critical role in ensuring the security and integrity of the Apple Pay ecosystem.

Financial institutions assess various factors when determining transaction limits, including account activity, creditworthiness, and fraud prevention measures. By setting limits tailored to each account, banks can mitigate risks associated with unauthorized transactions, excessive spending, and potential fraud. This helps protect both consumers and merchants from financial losses.

For instance, banks may set lower limits for debit cards linked to checking accounts, where funds are directly withdrawn, compared to credit cards, which offer a line of credit. Additionally, banks may adjust limits based on a customer's spending history and risk profile. By understanding these regulations and how they impact transaction limits, users can manage their finances effectively and avoid declined transactions.

Overall, bank regulations are an essential aspect of "The Apple Pay Maximum Amount: Discoveries And Insights." They enable financial institutions to balance security and convenience, fostering trust and confidence in the Apple Pay system.

Payment Method

Within the context of "The Apple Pay Maximum Amount: Discoveries And Insights," the payment method used can significantly impact transaction limits. Credit cards, in particular, often come with higher limits compared to debit cards.

- Credit vs. Debit: Credit cards are linked to a line of credit, allowing users to borrow funds up to a predetermined limit. Debit cards, on the other hand, are directly linked to a checking account, and transactions are deducted from the available balance.

- Risk Assessment: Credit card issuers typically set higher limits due to the inherent risk associated with extending credit. They assess factors such as credit history, income, and debt-to-income ratio to determine the creditworthiness of the cardholder.

- Fraud Protection: Credit cards offer stronger fraud protection measures, such as zero liability for unauthorized purchases and purchase protection. This reduces the risk for both consumers and merchants, allowing for higher transaction limits.

- Convenience and Flexibility: Higher limits on credit cards provide greater convenience and flexibility for users, enabling them to make larger purchases or manage unexpected expenses.

Understanding the differences in transaction limits based on payment method is crucial for effective financial management. By choosing the appropriate payment method for their needs, users can optimize their Apple Pay experience and avoid declined transactions.

In-App Purchases

Within the context of "The Apple Pay Maximum Amount: Discoveries And Insights," understanding the differing limits associated with in-app purchases is essential. In-app purchases, which occur within mobile applications, may have their own unique transaction limits, distinct from contactless or online payments.

This differentiation stems from various factors, including the app store's policies, the app developer's settings, and the user's account status. App stores often impose limits on in-app purchases to prevent excessive spending or unauthorized transactions, particularly for minors or users with restricted accounts. Additionally, app developers may set their own limits based on the nature of the in-app purchases, such as virtual goods or subscriptions.

Recognizing the potential differences in limits for in-app purchases empowers users to plan their spending and avoid declined transactions. By being aware of the specific limits applicable to the app and the user's account, individuals can manage their finances effectively and make informed decisions about in-app purchases.

Online Transactions

In the context of "The Apple Pay Maximum Amount: Discoveries And Insights," the higher limits associated with online transactions are directly tied to the enhanced security measures employed in these transactions.

- Secure Protocols: Online transactions often utilize secure protocols such as SSL/TLS encryption, which protect sensitive data during transmission, reducing the risk of unauthorized access and fraud.

- Verified Merchants: Many online platforms implement merchant verification processes to ensure the legitimacy of businesses and minimize the chances of fraudulent transactions.

- 3D Secure Authentication: Online payments frequently employ 3D Secure authentication, an additional layer of security that requires cardholders to verify their identity through a separate channel, such as a one-time password or biometric authentication.

- Fraud Monitoring: Online payment systems often have robust fraud monitoring systems that analyze transaction patterns and flag suspicious activities, helping to prevent unauthorized transactions.

The combination of these security measures allows online transactions to have higher limits compared to other payment methods. By ensuring the integrity and security of online payments, Apple Pay and other online payment platforms provide users with the confidence to make larger purchases and manage their finances effectively.

Temporary Increases

Within the context of "The Apple Pay Maximum Amount: Discoveries And Insights," temporary increases in transaction limits offer a unique perspective on the dynamic nature of these limits. Merchants and banks may occasionally adjust limits upward for specific promotions or purchases, providing valuable insights into the factors that influence these decisions.

- Promotional Strategies: Merchants may temporarily increase limits during promotional periods to encourage larger purchases and drive sales. This strategy is commonly employed during seasonal sales, holiday shopping, or special events.

- High-Value Transactions: Banks may temporarily raise limits for high-value purchases, such as luxury goods or large appliances. This accommodation allows customers to make significant purchases without exceeding their usual spending limits.

- Customer Loyalty: Merchants may offer temporary limit increases as a reward for loyal customers or to incentivize repeat business.

- Risk Assessment: Banks and merchants consider various factors when evaluating requests for temporary limit increases. These include the customer's financial history, the nature of the purchase, and the merchant's reputation.

Understanding the concept of temporary increases empowers users to take advantage of promotional opportunities and make informed decisions about their spending. It also highlights the flexibility and adaptability of Apple Pay's transaction limit system, which can be adjusted to accommodate specific circumstances and user needs.

FAQs on "The Apple Pay Maximum Amount

This section addresses common questions and concerns related to "The Apple Pay Maximum Amount: Discoveries And Insights".

Question 1: What factors determine the Apple Pay maximum amount?

The Apple Pay maximum amount is influenced by various factors, including merchant policies, bank regulations, payment method, transaction type, and temporary adjustments for promotions or high-value purchases.

Question 2: Why do contactless payments have lower limits than in-app or online purchases?

Contactless payments prioritize convenience and speed but have lower limits due to reduced security measures compared to in-app or online purchases, which often require additional authentication steps.

Question 3: How do transaction limits help prevent fraud?

Transaction limits act as a safeguard against unauthorized transactions and scams by restricting the amount that can be spent without proper authorization. They enable banks and Apple Pay to monitor transactions and flag suspicious activities.

Question 4: Can merchants set their own Apple Pay maximum amounts?

Yes, merchants have the flexibility to establish their own maximum transaction amounts for Apple Pay payments. This allows them to tailor limits based on their business needs and risk tolerance.

Question 5: Why do credit cards generally have higher limits than debit cards?

Credit cards are linked to a line of credit, allowing for higher spending limits, while debit cards are directly tied to available funds in a checking account. Credit card issuers assess creditworthiness to determine limits.

Question 6: How can I request a temporary increase in my Apple Pay limit?

Temporary limit increases may be granted by merchants or banks for special promotions or high-value purchases. Contact your bank or the specific merchant to inquire about eligibility and requirements.

Understanding these factors and frequently asked questions empowers users to navigate Apple Pay transaction limits effectively, manage their finances, and make informed decisions about their spending.

Transition to the next article section: Additional Tips and Best Practices for Managing Apple Pay Limits

Tips for Managing Apple Pay Transaction Limits

Understanding the Apple Pay maximum amount is crucial for effective financial management. Here are a few tips to help you navigate these limits and optimize your Apple Pay experience:

Tip 1: Check with Your Bank or Credit UnionContact your financial institution to inquire about specific transaction limits associated with your Apple Pay account. They can provide details on any limits imposed based on your account type, creditworthiness, and fraud prevention measures.

Tip 2: Be Aware of Merchant PoliciesSome merchants may set their own maximum transaction amounts for Apple Pay payments. Familiarize yourself with these limits before making large purchases to avoid declined transactions.

Tip 3: Choose the Right Payment MethodCredit cards typically have higher transaction limits compared to debit cards. If you anticipate making large purchases, consider using a credit card linked to your Apple Pay account.

Tip 4: Contact Your Bank for Temporary IncreasesFor special occasions or high-value purchases, you can contact your bank to request a temporary increase in your Apple Pay transaction limit. However, approval is subject to your financial history and the bank's risk assessment.

Tip 5: Monitor Your TransactionsRegularly review your Apple Pay transaction history to track your spending and identify any unauthorized activities. Report any suspicious transactions to your bank immediately.

Tip 6: Use Additional Security MeasuresEnable additional security features on your Apple Pay account, such as Face ID or Touch ID, to prevent unauthorized access and protect against fraud.

Tip 7: Be Informed About UpdatesStay informed about any changes or updates to Apple Pay's transaction limit policies by referring to official sources or contacting your financial institution.

Following these tips will help you manage Apple Pay transaction limits effectively, make informed financial decisions, and maximize the security of your Apple Pay account.

Transition to the article's conclusion: Conclusion: The Significance of Understanding Apple Pay Maximum Amounts

Conclusion

In the realm of digital payments, understanding the Apple Pay maximum amount is paramount for effective financial management, fraud prevention, and overall security. This article has explored the various aspects of "The Apple Pay Maximum Amount: Discoveries And Insights," providing valuable knowledge and practical tips for optimizing your Apple Pay experience.

Key takeaways include the dynamic nature of transaction limits, influenced by factors such as merchant policies, bank regulations, payment methods, and specific purchase scenarios. By being aware of these limits and implementing appropriate strategies, individuals can proactively manage their spending, avoid declined transactions, and safeguard their financial well-being. Furthermore, regular monitoring of transactions and prompt reporting of suspicious activities are crucial for maintaining account security.

As the digital payment landscape continues to evolve, staying informed about updates and advancements related to Apple Pay maximum amounts is essential. By embracing these insights and following the recommended best practices, users can harness the full potential of Apple Pay while ensuring responsible and secure financial practices.

Uncover The Enigma: Selena Gomez's Sister's Secret Abode RevealedDive Into Carly Simon's Marital Odyssey: Love, Loss, And Legacy UnveiledUnveiling The Enigma: Discoveries And Revelations In Shelby Stanga's Personal Life

How Does Apple Pay Work? (Infographic) Gotechtor

Apple Pay Is Faster, Easier, More Secure, and More Private Than Using